TL;DR Some of the most famous names on the high street have suffered in recent years and struggled to keep up with the online-only upstarts who are taking big slices of the e-commerce pie. Bold propositions, strategies to focus on differentiators and being brave in their online offerings might be their only chance to survive.

The retail industry has been one of the biggest victims of the Covid-19 lockdown as stores closed and sales plummeted.

April saw the biggest decline in retail on record with sales in clothing and footwear dropping 50% and household goods 45%.

This was against the backdrop of big high street names going into administration. The likes of Debenhams, House of Fraser and Mothercare are just some of the regular features of our high streets which face an uncertain future after periods of poor commercial performance.

These retail giants are suffering for a number of reasons: low consumer confidence which has reduced spending, the rise of online-only competitors, rising business rates, an increase in the minimum wage, and higher cost prices as a result of the decline in the value of the pound due to Brexit.

John Lewis’ profits have gone from £250m to £50m in three years and Next has warned of a significant drop in sales due to the coronavirus pandemic.

However, April also saw the largest increase on record, of 18%, in non-store retail and John Lewis’ online sales now account for more than half its revenue.

So, what does the future hold for department stores in the fast-paced world of e-commerce?

Are you propositioning me?

One of the biggest challenges for the middle-market department stores is providing a clear, understandable proposition; being able to answer the customer question ‘why should I buy from you?’

The reason for their growth – offering a range of products from a range of brands under one roof – is now, arguably, their biggest weakness, particularly as online specialists provide more choice within a niche and the brands department stores have partnered with seek to take advantage of better profit margins from selling direct from their own e-commerce websites.

Manchester Metropolitan University retail senior lecturer Amna Khan recently told Retail Gazette: “The downward trend is continuing simply because mid-market department stores such as House of Fraser and Debenhams do not offer consumers a unique proposition or experience when they shop.”

While this refers directly to the in-store experience, this proposition conundrum translates across online as well.

E-commerce specialists have taken the ethos of the department store and ramped it up to a whole new level.

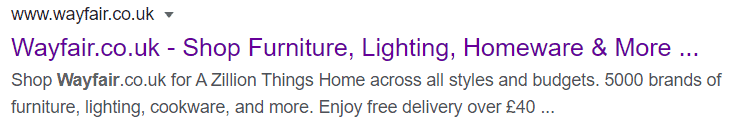

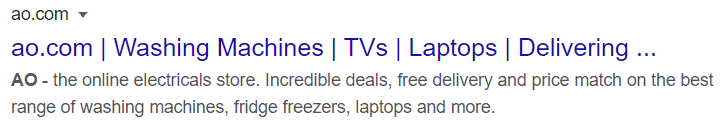

Where department stores might offer a handful of brand options in-store and online, the likes of Wayfair, ao.com and behemoth Amazon aren’t limited to the product range they can offer. As we’ve seen, brands are using Amazon as a direct sales channel to take advantage of their huge visitor numbers.

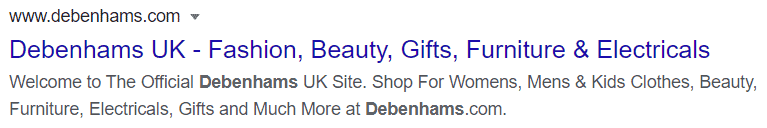

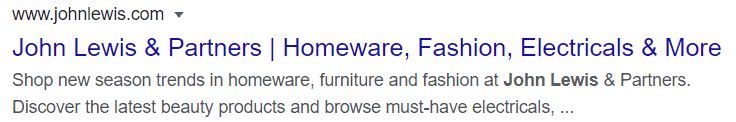

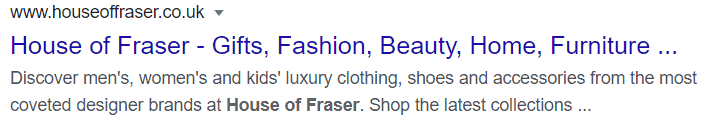

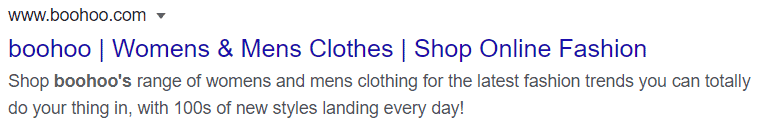

This lack of a clear proposition for those struggling department stores can be seen in the online world. Comparing the meta descriptions – the paragraph of text which is displayed in search engines below the name of the brand – of Debenhams, John Lewis and House of Fraser with e-commerce specialists Boohoo, Wayfair and ao.com is telling.

They’re functional but are there compelling reasons to buy? I’d argue not.

Then look at these:

Similar in many respects but check out the meta description language: ‘the latest fashion trends you can totally do your thing in’, ‘shop for a zillion things home’, ‘5000 brands’, ‘free delivery’ and ‘incredible deals’.

In isolation, you can be forgiven for thinking that they’re just words – but they point to e-commerce retailers with more personality and a stronger understanding of what they’re offering to consumers.

Debenhams is devoting the first seven words of its meta description to telling those searching for Debenhams that its website is the official website of Debenhams…you get my point.

Marketing departments in these mid-market department stores have the opportunity to really step up to the plate now and be bold and brave about how their stores meet customer needs and drive customer desire, particularly post lockdown.

High-street advocate Mary Portas, one of the biggest names in the retail industry in the UK, has urged brands to take stock and re-evaluate their business.

She writes on the Daily Mail website: “It should be out with bland and boring, and in with bold and brilliant. It’s all over for behemoth retailers pumping products out, all eyes on the profit. Post-Covid, we will be looking for shops that boost our self-esteem and understand how we feel.

“Yet I believe this crisis – while it will shake our High Streets to the core – could also profoundly shape the future of fashion in positive ways. It is an opportunity for brands that have lost their way to reset and reinvigorate. And there are plenty of those.”

The department and clothing stores which are still performing well – at least before lockdown – are those targeting a more defined customer set.

Luxury retailers such as Selfridges, Harvey Nichols and Fortnum and Mason have reported strong performances while, at the other end of the market, Primark reported increases in revenue and operating profit for the year to September 2019.

Bringing two worlds together

Any such reset of the struggling stores is likely to have a significant focus on the in-store experience.

Once shops reopen their doors they are likely to see an initial surge of customers who are simply happy to be out of the house and back on the high street.

But Portas has a warning: “The message around the great reopening is necessarily largely one of safety, hygiene, practicality. But if that’s all I am getting by venturing into a shop for the first time in three months – frankly, why would I bother?”

It begs the question whether a significant enough number of those born-again in-store shoppers will return. And especially if they will return to the tired department stores which haven’t taken the opportunity to raise their game during lockdown.

Some are turning to experiential retail – or ‘shoppertainment’ as it has been dubbed – with John Lewis offering ‘experience playgrounds’ to keep customers in-store for longer.

These include spaces to create home interiors with mood boards, book consultations, cookery school classes and demos and personal styling

Visit the John Lewis website though and it almost feels like you’re dealing with a different brand.

Mood boards – could be on the website. Online consultations – could be on the website. Cookery advice – could be on the website. Personal styling advice/consultations – could be on the website.

We can only assume that John Lewis has made a conscious decision to not provide this type of customer experience online – but that seems an opportunity missed, particularly when customers have been unable to get through the doors.

Recent research shows that 84% of consumers are demanding more assistance and guidance when searching for products online so there’s a big opportunity to keep online customers on a website.

Online and offline have the ability to work hand-in-hand and we’ve seen it at its best with the now-common click-and-collect offering.

But this can go further. How about offering the ability to click-to-try, for example? Search online, see a top that you like but want to see how it looks first before buying. It could work on the same premise as click-and-collect and give customers the assurance that their size is in store waiting for them.

This kind of thinking would also provide physical stores to take advantage of cross-selling – something successful e-commerce websites are adept at.

Experiential marketing is being touted as a key next-generation driver for e-commerce and we’ll likely see in-store product demos, workshops, fashion shows and more streamed on digital channels to attract a wider audience.

Put the fun into functional

Having a well-structured website is one thing and should be a given in 2020 – even though some traditional department stores have struggled with this in the past – but those struggling department stores need to provide more.

Google Trends data shows how much the retail world has changed, with searches for online fashion brand Boohoo now at the same level for Debenhams.

It’s only a matter of time before the Boohoo red line sits well above the Debenhams blue line…unless changes are made.

As Mary Portas says, get away from bland and boring and go bold and brilliant.

And don’t limit this to the physical store. Make the website – just as with the physical store – a destination; a place to enjoy yourself.

Virtual reality stores, gamification on websites, influencer takeovers…these department stores need to form strategies which set them apart; best practice needs to be adopted in certain areas but that alone isn’t going to turn around the fortunes of some of our most well-known stores.

Summary

The big-named, mid-market department stores have got it tough. They’re not sure of their target market, they don’t have a compelling proposition and, in some cases, their online experience is bland.

However, they are still big, big players and can turn the corner with a bit of bravery and attitude. Far better to have tried and failed than to have dithered and failed.

As Joseph Heller, the author of the famous satirical war novel, Catch 22, said: “I’m gonna live forever, or die trying.”

*The main image for this article is genuine – the Debenhams site was offline when I was conducting research